The digitalization and automation of business processes has become an essential part of corporate strategy. Companies are striving for process harmonization and almost complete automation of their processes on a global level. The declared goals here are to increase efficiency and reduce costs in order to gain a competitive advantage over their competitors. This transformation towards "no-touch processes", in which human intervention is reduced to a minimum, is often seen as the optimal goal in the context of a financial transformation.

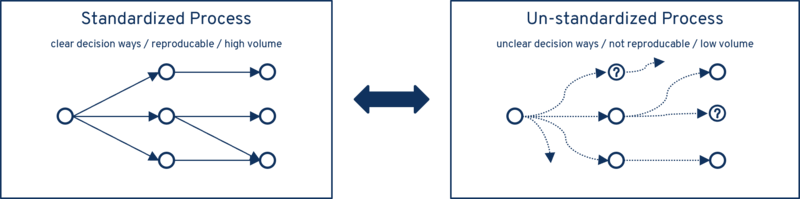

The no-touch approach, i.e. (almost) complete process automation, is not limited to a specific business model or sector. Processes for which this approach is frequently chosen have a high degree of standardization and repeatability. This includes end-to-end processes (E2E processes), such as order-to-cash, purchase-to-pay or acquire-to-retire.

There is generally a lot of scope here due to the high transaction volume within recurring processes, which are currently often handled exclusively in shared service centers. On the other hand, there are technical solutions whose automation potential has not been exhausted, although this would be possible without high ongoing costs (e.g. via SAP S/4 Finance).

Based on these simple theoretical assumptions, practical implementation is often much more complex and challenging. The basic prerequisite for meaningful financial process automation is always prior process standardization. However, initiatives to create a uniform standard often fail because decision criteria in the process are too complex, as they have usually grown with the company in an unstructured way over time. As a result, standardization and subsequent automation are often difficult to implement, as not only processes have to be analyzed, but habits also have to be broken.

Despite the ongoing operationalization of artificial intelligence methods, in particular the sub-discipline of machine learning, many processes still require manual intervention and human interaction.

It often turns out that the theoretical business case cannot be realized during implementation. Instead of the expected increases in efficiency, cost savings or quality improvements, considerable resources and costs are required. The frequent consequences are inflexible processes with limited responsiveness, a reduced focus on customer needs and rising infrastructure costs.

So let's bundle these challenges into one fundamental question: how "inhuman" should financial process automation be? In other words, what is the optimal balance between human and machine involvement in financial processes to maximize efficiency and benefit?

Due to the large number of factors influencing the answer to this question, there is no universally valid answer - it always depends on the company situation, the process, the project context and many other factors and must be assessed individually.

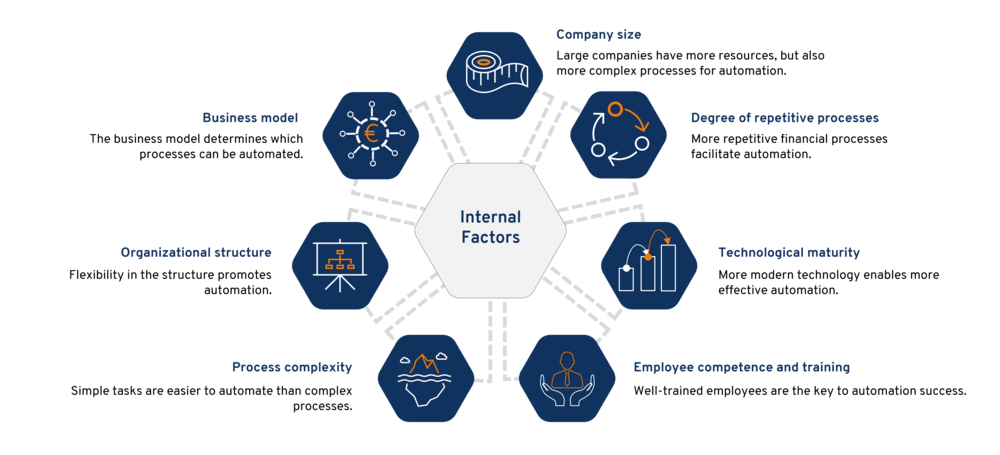

However, there are key influencing factors that must be taken into account in any decision to implement process automation. We divide these into internal and external factors:

Internal factors

Internal factors are characteristic features, conditions or circumstances within a company. As a rule, they are within the sphere of control or direct influence of the company itself. The wealth of internal factors that influence the degree of process automation is complex and requires individual examination with regard to their characteristics and relevance in the respective company. Aspects such as the company's business model, the size of the company, the proportion of repetitive processes in relation to the overall process landscape and the corporate culture are the primary factors to consider. These and other factors are shown in the following diagram.

To better understand how these factors affect the optimal level of automation for companies, some of the most important ones are discussed below.

A company's business model has a significant impact on how well it lends itself to process automation. Some types of business, such as the automotive industry and e-commerce, are ideal for automating financial processes, such as invoicing or payment processing, due to their high transaction volumes.

However, other industries, such as healthcare, consulting firms or the luxury goods industry, require more flexibility and human judgment. In these areas, financial processes are often less standardized and therefore more difficult to automate. Examples include the management of insurance claims or the billing of customized services.

The size of the company in combination with key financial figures is also an important influencing factor. Larger companies generally have more resources to invest in automation technologies and can therefore benefit from economies of scale, which in turn reduce the costs of further automation. They have more standardized and repeatable processes that are suitable for automation. In smaller companies, these factors are generally present to a much lesser extent. However, there can also be a positive business case for individual processes, but the economies of scale are (of course) not as strong here.

Companies whose business processes are highly repetitive and continue to be standardized and integrated can implement automation technologies more effectively. The system landscape and the hosting setup ("where are the automation solutions operated") are a decisive influencing factor here. This includes, for example, co-location setup, cloud strategy, SaaS and others. Companies whose processes are less integrated have considerably more work to do here.

As with many other initiatives, corporate culture has a significant impact on the likelihood of success of an automation initiative. Companies that have a culture of innovation and change can implement changes more easily and effectively and better deal with the challenges that automation always brings.

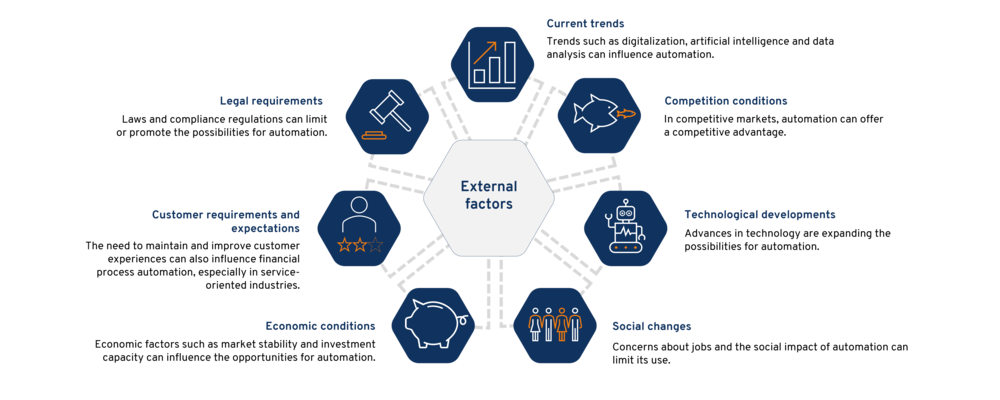

External factors

In contrast to internal factors, external factors include characteristics, conditions or influences that are outside the direct control of a company. Nevertheless, or precisely because of this, they play a decisive role in determining the balance between automation and manual intervention in financial processes. These factors, including legal requirements, current trends, competitive conditions, technological developments, societal changes, economic conditions and customer requirements, can present both opportunities and challenges for automation and require continuous adaptation of the strategy in this regard. The following figure summarizes some of the external factors:

Let's start by looking at a global technology company. Due to its enormous size and high volume of financial transactions, it relies on automation technologies to ensure efficiency and accuracy. However, legal requirements in some areas may require human intervention to ensure compliance. Current trends such as artificial intelligence and data analytics could further drive automation, but societal changes, particularly concerns about the impact of automation on jobs, require careful consideration. Competitive conditions may require increased automation to gain a competitive advantage, while customer needs require a balance between automation and individualized attention.

A start-up company, on the other hand, has different challenges and opportunities. With more limited resources, it must invest wisely in automation technologies that bring the greatest benefit to its financial transactions. Economic conditions play a decisive role here. Current trends and technological developments may open up new opportunities for automation, while societal changes and customer needs may require a greater emphasis on human intervention. Especially in service-oriented industries, the need to ensure a high level of customer satisfaction may limit automation.

Overall, these external factors influence the balance between automation and human intervention in financial processes and require careful consideration and continuous adjustment of business strategy.

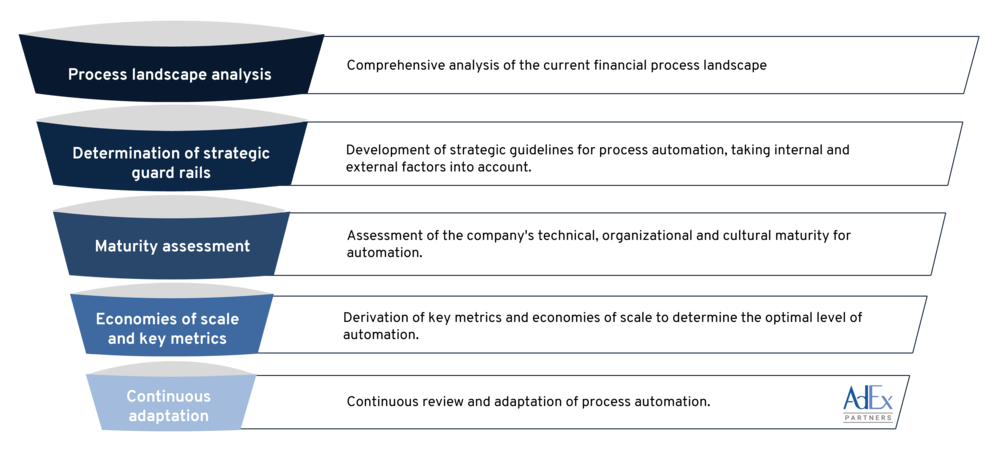

The AdEx Partners path to a healthy human-machine relationship for financial processes

At AdEx Partners, we understand that the decision of how far financial processes should be automated is complicated and multi-faceted. The optimal solution depends heavily on the specific characteristics and needs of each company, so we emphasize an in-depth and thoughtful approach.

Process landscape analysis:

To begin with, we carry out a comprehensive analysis of the current process landscape in the finance area, identifying and analyzing specific processes such as order-to-cash, purchase-to-pay, account-to-report or acquire-to-retire.

Determination of strategic guard rails:

Based on this analysis, we then develop customized strategic guidelines for automation. This involves determining the current status (AS-IS) of the degree of automation by analyzing which technologies are currently being used and to what extent. We clearly identify the goals and expectations of automation, such as efficiency gains and cost savings, while also considering risks and challenges and developing strategies to overcome them. We consider both internal and external factors and go beyond the technical aspects of automation to include organizational, cultural and strategic aspects.

Maturity assessment:

An essential step in our approach is to assess the maturity of the financial organization in 3 dimensions. We assess both technical maturity, such as the availability and quality of the financial applications used, organizational maturity, such as the company's ability to manage and implement change, and cultural maturity, such as the acceptance and support of automation by employees.

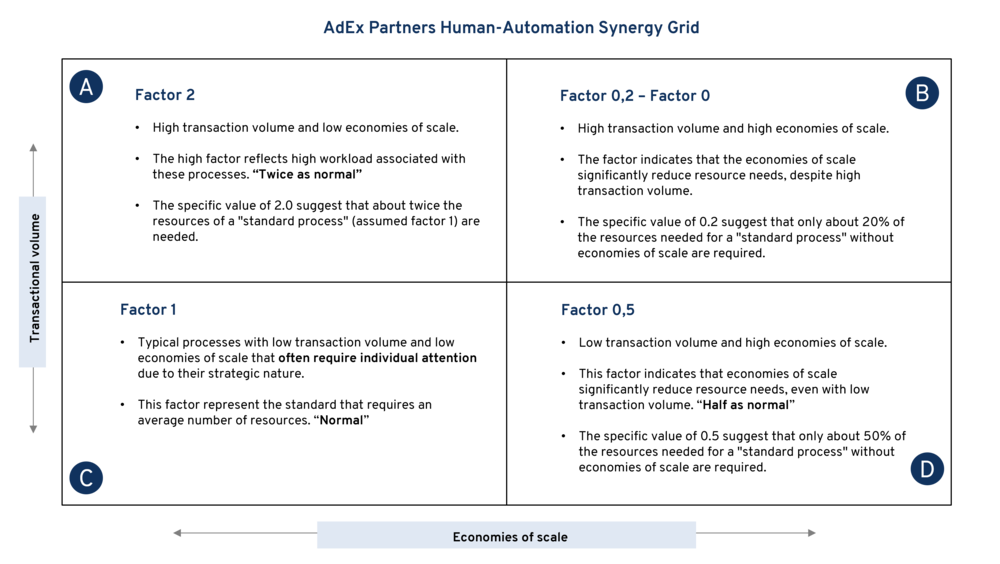

Economies of scale and key metrics:

From this analysis and assessment in conjunction with the previously conducted AS-IS analysis, we derive a number of key metrics that assist us in determining the optimal level of automation to paint the target picture (To-BE) accordingly. These include the process vision, the digital vision, the data strategy, the independence factor and the integration factor. An effective tool here is also the application and derivation of economies of scale in relation to the necessary automation factors (e.g. the transaction volume of the financial processes). We determine the respective factors individually for and in consultation with the client.

Continuous adaption:

For us, the automation of financial processes is a continuous process. We are therefore prepared to regularly review and adapt our clients' automation to respond to changes in regulatory requirements, business conditions or technological developments. This requires not only technical know-how and organizational skills, but also a culture of continuous improvement and lifelong learning, which we cultivate intensively at AdEx Partners.

We do not see process automation as an end in itself, but as a tool to improve the efficiency and competitiveness of our customers. Our aim is not to play people and machines off against each other, but to recognize and combine their respective strengths. This creates a symbiosis that brings out the best of both worlds and uses each resource where it is strongest. Thanks to our approach and our ability to find the right balance, we are convinced that process automation can be a powerful tool. It helps companies achieve their goals and compete successfully in the digital world.

AdEx Partners offers a comprehensive approach from the analysis to the implementation of automation strategies, adapted to the current situation in your company. Based on the results, we develop customized strategic implementation concepts and recommendations for action with you and for you.